stamp duty exemption malaysia 2018

Similarly you wont have to pay stamp duty on land valued at less than 300000 and a concessional rate applies to land valued between 300000 and 400000. Custom Duty is an indirect tax levied on import or export of goods in and out of country.

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Stamp duty exemption on Perlindungan Tenang insurance policies and takaful certificates with a yearly premium contribution.

. Malaysia Sales Tax 2018. Currently there are some circumstances where you may be able to avoid or reduce stamp duty such as being a. PropertyGuru Tip The stamping is to make the Tenancy Agreement legal and admissible in court and is done by the Inland Revenue Board of Malaysia LHDN.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. 1240th or 04 but a massive 500 exemption applied exempting most people from tax. Also in the initial stages the total investment made.

When goods are exported outside India the tax is known as export custom duty. The tax collected by Central Board of Indirect Taxes and Customs. You also need to make sure you know about two additional fees that come with the renting process the stamp duty fees and administration charges for a Tenancy Agreement.

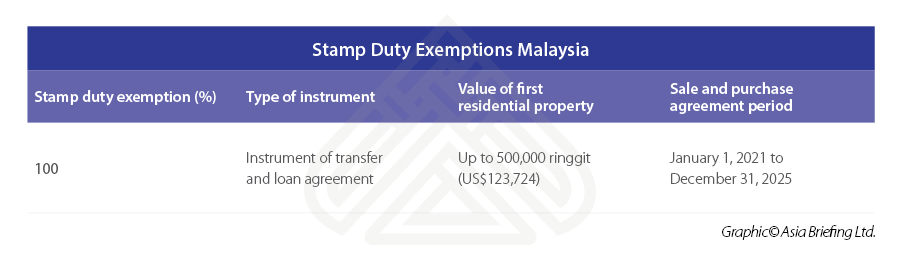

We care about the privacy of our clients and will never share your personal information with any third parties or persons. Stamp duty exemption on contract notes for sale and purchase transaction of structured warrant or exchange-traded fund approved by the Securities Commission executed from 1 January 2018 to 31 December 2025. Malaysia Service Tax 2018.

A sends an email from Malaysia offering to sell property to B. B sends an email from Singapore accepting As offer. However while countries with high levels of secrecy but also high rates of taxation most notably the United States and Germany in the Financial Secrecy Index FSI rankings can be.

Applying for special GST registration Group registration and Divisional registration. East Coast Economic Region Malaysia ECER as the Gateway to the Asia Pacific Region offers competitive incentives such income tax exemption of 100 for 10 years stamp duty exemption on land or building purchased for development customised incentives and also non-fiscal incentives to approved companies. After public consultation the government released a progress paper as an update on the proposal.

Tax Audit Framework available in Malay version only Superceded by the Tax Audit Framework 15122019 - Refer Year 2019. A visa may also entitle the visa holder to other privileges such as a right to work study etc. The visa policy of Australia deals with the requirements that a foreign national wishing to enter Australia must meet to obtain a visa which is a permit to travel to enter and remain in the country.

Must contain at least 4 different symbols. Employments contract stamped RM1000 at duty stamp officeEmployment Contractpdf available at website JIM-2 original copies. Stamp Duty Exemption Order.

The SSM is the governing. Such a move will benefit a wider pool of buyers especially the upgraders said Rehda president Datuk NK Tong. Entry made by CDP in its register to effect the transfer of scripless shares is exempt from stamp duty.

And may be subject to conditions. Stamp duty is an upfront cost that a buyer has to consciously set aside when he. In February 2020 as part of Indias.

It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be. Get the latest international news and world events from Asia Europe the Middle East and more. You may be entitled to a one-off exemption from duty if you buy a home valued at 330000 or less or a one-off concession from duty when you buy a home valued from 330001 to 750000.

If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. Since 1994 Australia has maintained a universal visa. When goods are imported from outside the tax known as import custom duty.

SST Treatment in Designated Area and Special Area. ABSD Rates from 12 Jan 2013 to 5 Jul 2018 ABSD Rates from 6 Jul 2018 to 15 Dec 2021 ABSD Rates on or after 16 Dec 2021. Original copy of Marriagebirth certificate.

Malaysia Thailand Denmark Mexico Turkey Fiji Netherlands United Arab Emirates Finland. Sendirian Berhad Sdn Bhd Company in Malaysia Business Owners Must Know. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer.

Stamp Duty is a tax on dutiable documents relating to immovable properties in Singapore and stocks and shares. A visa from the Latin charta visa meaning paper that has been seen is a conditional authorization granted by a polity to a foreigner that allows them to enter remain within or leave its territory. Pensioner duty exemption or concession The government provides stamp duty relief for eligible pensioners.

All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. KUALA LUMPUR Oct 7. Original.

Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018. Visas typically include limits on the duration of the foreigners stay areas within the country they may enter the dates they may enter the number of permitted visits or if the. NSW Stamp Duty exemptions.

In November 2020 the NSW government announced plans to phase out stamp duty in favour of an annual property tax. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. Exemption is given on import duty for raw materials and components that are imported by the companies.

In some traditional definitions a tax haven also offers financial secrecy. In Western Australia first-home buyers do not have to pay any stamp duty on homes valued at less than 430000. Original.

A tax haven is a jurisdiction with very low effective rates of taxation for foreign investors headline rates may be higher. Ibu Pejabat Lembaga Hasil Dalam Negeri. All businesses in Malaysia are required to be registered with the Companies Commission of Malaysia SSM.

A concessional rate applies to homes valued between 430000 and 530000. Applying for exemption from GST registration. When first enacted this charged a rate of one penny in the pound ie.

A Sendirian Berhad Sdn Bhd company in Malaysia is a private limited business entity which can be started by both locals and foreigners. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. The Real Estate and Housing Developers Association of Malaysia Rehda has appealed to the government to consider extending the 75 stamp duty exemption to all buyers and not just first-time house buyers.

6 to 30 characters long. The two-year threshold was extended to five years in 2018 and ten years in 2021. ASCII characters only characters found on a standard US keyboard.

Software Sale and Development. Stamp Duty Exemption Order.

Malaysians Guide To The Latest Property Stamp Duty Iproperty Com My

Buyer S Stamp Duty Guide For Singapore Property Buyers What It Is And How Much To Pay Up To 4

List Of Stamp Duty Exemption Orders In Malaysia

Malaysia S 2018 Budget Salient Features Asean Business News

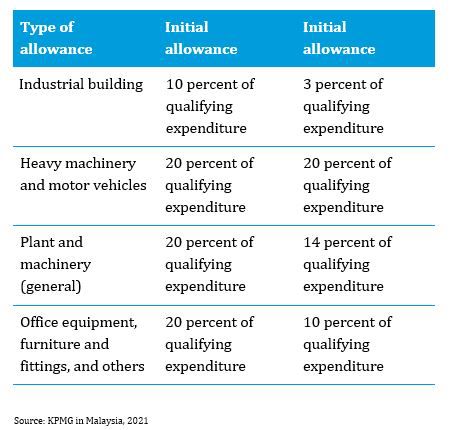

Malaysia Taxation Of Cross Border M A Kpmg Global

Shares With Stamp Duty Exemption For 2018 Felicity I3investor

Rehda Consider Extending 75 Stamp Duty Exemption To All Buyers Not Just First Time House Buyers Edgeprop My

Lock Stock Barrel Set Aside Sum For Stamp Duty

Govt Announces I Miliki Offers Stamp Duty Exemption For First Time Homebuyers

Indirect Tax And Stamp Duty Measures In Malaysia For 2021

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Vodafone Group Public Ltd Co 2018 Annual Transition Report 20 F

Malaysia S Latest Stamp Duty Update For 2018 Iqi Global

Malaysian Wealth Management Latest Developments

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Exemption For House Buyers Infographics Propertyguru Com My

0 Response to "stamp duty exemption malaysia 2018"

Post a Comment